|

| Best Homeowners Insurance Companies in Florida 2023's |

Owning home insurance is a significant financial investment, and safeguarding it is crucial. However, not every homeowners insurance policy provides equal coverage. Our ranking of the Top Home Insurance Companies in Florida can assist you in comparing and selecting the best one that suits your requirements.

The top Florida homeowners insurance companies will be examined in-depth in this guide, along with comprehensive details on what each company has to offer. This article will assist you in finding the finest insurance company for your Florida home, whether you're a first-time home buyer or are just looking for new coverage.

2023's Best Home Insurance Provider Comparison in Florida

When looking for homeowners insurance in Florida, it's essential to consider not only the coverage options but also the financial stability of the insurance company. In this comparison, we will look at some of the best homeowners insurance companies in Florida based on their financial strength ratings of A++, A+, and A.

Home Insurance Provider Comparison in Florida With Finacial Strength A++

We have analyzed some of the top Florida homeowners insurance providers with financial strength ratings of A++ to assist you in making an informed choice:

|

| Homeowners Insurance Providers With Financial Strength A++ |

Homeowners insurance A++ rated companies:

- USAA: With a financial strength rating of A++, they have a strong reputation for financial stability and customer service, making them a trusted choice for homeowners.

- State Farm: State Farm is renowned for its extensive homeowner insurance coverage and has a financial strength rating of A++.

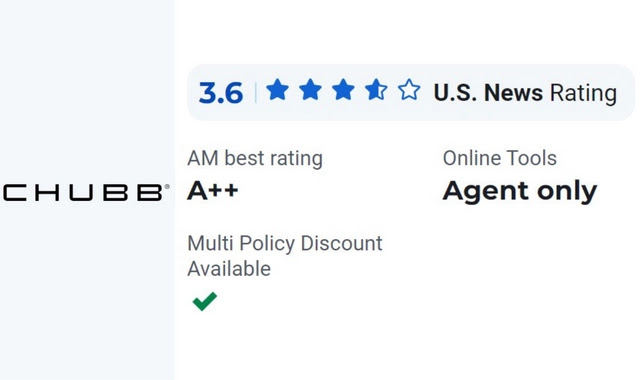

- Chubb: Chubb is a reputable insurance provider with an A++ financial strength rating.

Home Insurance Provider Comparison in Florida With Finacial Strength A+

Amica and Nationwide are two providers in the state of Florida who frequently score highly for their financial strength:

Home Insurance Provider Comparison in Florida With Finacial Strength A

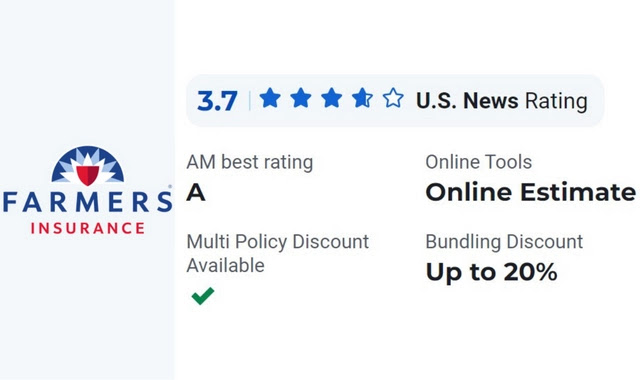

With an A financial strength grade from A.M. Best, Liberty Mutual, and Farmers are two well-regarded providers of homeowners insurance in Florida. The best alternative for you will depend on your unique demands and available funds, despite the fact that both businesses provide a variety of standard and customized coverage options. You may choose a home insurance company with confidence by carefully analyzing aspects including coverage options, price, and financial stability. In the end, it's crucial to pick a supplier who can confidently and worry-free protect one of your most valuable assets.

|

|

|

Ultimately, It's crucial to compare different home insurance providers and consider things like pricing, policy alternatives, customer service, and financial soundness. You may feel secure knowing that your home and possessions are secured by a financially solid firm by looking at the financial strength rating of the insurance companies.

A Detailed Analysis of the Leading Home Insurance Companies in Florida

Having the proper insurance coverage is crucial for protecting your home and other assets. In Florida, there are many options available to you as a homeowner, which might make choosing one difficult. However, by carefully analyzing the best Florida home insurance companies, you may pick the plan that best suits your requirements and make an informed decision.

The rates listed are for demonstration purposes only. It is recommended to directly reach out to the insurance provider or agent for accurate quotes.

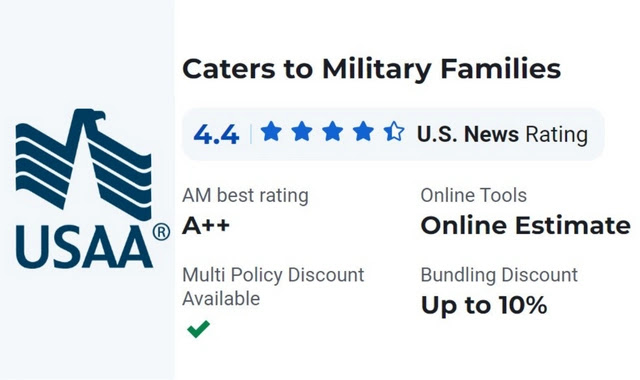

Usaa home insurance

|

| usaa home insurance reviews |

The USAA offers a broad range of insurance, finance, and investment options to its members. It has received high recognition, taking the top spot in our evaluation of the best homeowners insurance companies in Florida and earning an impressive A++ rating from AM Best.

USAA homeowner insurance policies provide fundamental protection for your dwelling, auxiliary buildings (such as standalone garages or sheds), and personal belongings. Additionally, USAA offers the option to add coverage for natural disasters like floods and earthquakes. Regrettably, USAA insurance is only open to those who are members, and membership is limited to current and former military personnel, their spouses, and their descendants.

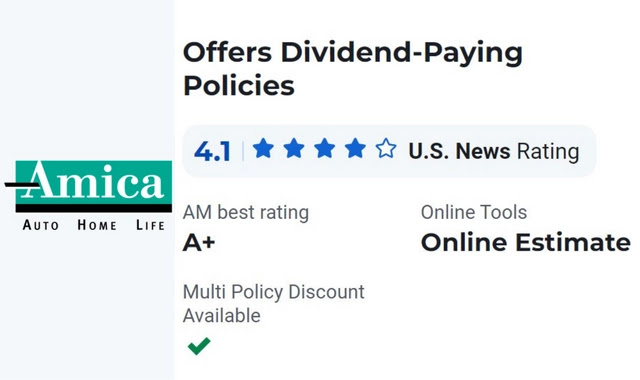

Amica home insurance

|

| amica mutual insurance reviews |

Amica, with its headquarters located in Rhode Island, stands as the runner-up in our ranking of the Best Homeowners Insurance Companies in Florida.

Aside from its standard homeowners insurance policy, Amica presents the Platinum Choice Home package that encompasses niche coverage for computer equipment, water backup/sump overflow, and extended protection for valuable items. Regrettably, Amica does not provide any dividends to customers residing in Florida. A company representative has stated that Amica is presently accepting limited applications for home insurance coverage, only for homes that adhere to a post-2001 building code standard and already have insurance in place.

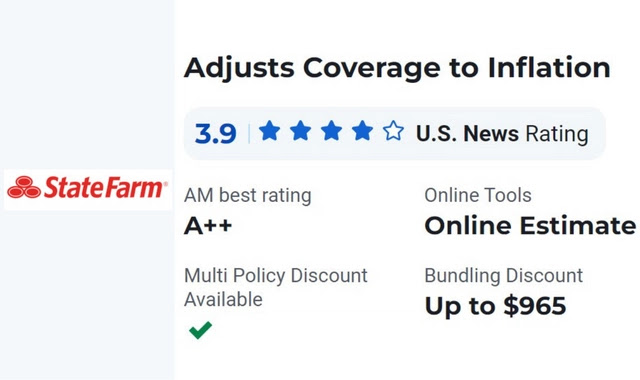

State farm home insurance

|

| state farm home insurance reviews |

State Farm, known for providing a variety of insurance, investment, and banking services across the United States, boasts an impressive A++ AM Best rating.

State Farm's standard homeowner insurance policy encompasses the fundamentals like your home, attached structures, and belongings within the property, as well as protection for liability and medical expenses. The company also provides the possibility of purchasing additional earthquake insurance, water damage coverage, and other specialized policies. Although its discounts may not be as extensive as those offered by other insurance providers, State Farm has a well-established network of local representatives and practical digital resources.

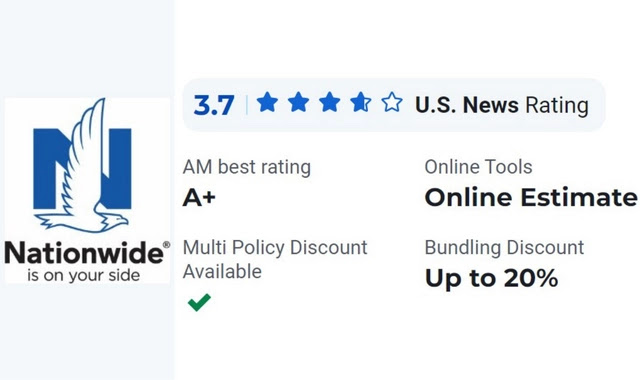

Nationwide home insurance

|

| nationwide home insurance reviews |

Established in 1926, Nationwide provides the standard coverage options commonly seen among the reviewed firms, along with elective additions like protection against water damage, earthquakes, and identity theft. Its discount offerings are comparable to other homeowners insurance providers in our evaluations and include discounts for a lack of claims, installing home safety equipment, and combining multiple policies.

Liberty Mutual home insurance

|

| Liberty Mutual home insurance reviews |

Liberty Mutual presents a range of insurance options apart from homeowner's insurance, such as renters, auto, pet, and education insurance. Its conventional homeowner's insurance plans encompass coverage for the dwelling, personal belongings, and personal responsibility. The firm provides flood insurance through the National Flood Insurance Program (NFIP).

Liberty Mutual provides various discounts, including for combining insurance policies and for being claims-free for a minimum of three years. The organization holds an A financial stability rating from AM Best.

Chubb home insurance

|

| chubb home insurance reviews |

Chubb is a worldwide insurance firm with an outstanding A++ financial rating from AM Best. It provides homeowner's, flood, and auto insurance as well as specialty insurance products specifically created to protect collectibles, boats, and cyber risks.

Chubb's Masterpiece Homeowners policy encompasses the standard policy essentials, including the added benefits of risk assessment, extended cost replacement and complementary property management services, available to homeowners with a secondary or holiday home situated in regions vulnerable to hurricanes.

|

| Farmers insurance reviews |

Farmers provides the standard homeowners insurance coverages including dwelling coverage, personal property coverage, liability coverage, and coverage for additional living expenses. Policyholders have the opportunity to receive discounts by enrolling in paperless billing, owning a recent home, or installing approved roofing materials. Bundling multiple policies with Farmers is also an option.

Farmers boasts an outstanding financial stability grade of A- from AM Best. You have the option of obtaining an insurance quote either online or through a phone call.

What is the Average Price for Home Insurance in Florida?

The cost of homeowners insurance can vary depending on several elements such as the age, dimensions, worth of your home and the type and extent of insurance coverage required. The premium of your policy will also be affected by your deductible, which is the sum you pay from your own funds after making a claim, and your coverage limit, which represents the maximum amount the insurer will pay to settle damages.

With the intention of offering insight into the expenses of a homeowner's insurance policy in Florida, we obtained data from several prominent home insurance providers in the state and utilized it to create the tables below.

The initial table presents the cost of a $100,000 liability policy for homes with dwelling coverage of $200,000, $300,000, $400,000, and $500,000. The subsequent table showcases the pricing for homes with equivalent amounts of dwelling coverage but with a $300,000 liability policy instead.

To obtain a customized perspective on the expenses of homeowner's insurance for your residence in Florida, utilize our list to choose insurance providers and obtain and examine quotes.

Yearly Average Premium per Company across All Florida ZIP Codes (*With $100,000 in liability coverage)

home insurance cost (*With $100,000 in liability coverage):

|

| home insurance cost (*With $100,000 in liability coverage) |

Yearly Average Premium per Company across All Florida ZIP Codes (*With $300,000 in liability coverage)

home insurance cost (*With $300,000 in liability coverage):

|

| home insurance cost (*With $300,000 in liability coverage) |

Strategies for Reducing Homeowners Insurance Costs in Florida

Multiple strategies exist to help reduce the cost of a Florida homeowners insurance policy:

- Obtain multiple quotes. One of the most effective ways to save money on Florida homeowners insurance is by conducting a comprehensive search and acquiring quotes from multiple insurance providers.

- Consult with an agent. As you search for insurance, look for a knowledgeable agent who can inform you about any potential discounts for which you may qualify.

- Modify deductibles or coverage. Boosting your deductible (the amount you pay after a claim) can lower your insurance premiums. The same applies when decreasing your coverage limits (the amount the insurance company pays after a claim). Although these adjustments can lead to lower premiums, it's essential to remember that either option may result in higher out-of-pocket expenses in the event you have to file a claim.

Comparing Common Discounts Across Top Companies

|

| Home insurance discount: usaa discount, Amica discount, State Farm discount, Nationwide discount, Liberty Mutual discount, Chubb discount, Farmers Insurance discount. |

How to Find the Ideal Home Insurance Company for Your Needs in Florida?

To discover the ideal Florida homeowners insurance company that aligns with your requirements, consider these steps:

- Assess the type and scope of coverage you require.

- Gather multiple insurance quotes.

- Examine various insurance firms, including the policies and protection they offer, their financial stability, and appraisals from experts and customers.

- Take into account your personal preferences, such as whether you prefer a local representative or the ease of managing your policy through an online platform.

What Is Covered By Florida Homeowners Insurance?

A typical homeowners insurance policy in Florida typically encompasses the following areas of coverage:

- The home structure itself, known as the dwelling.

- Outbuildings such as sheds, garages not attached to the home, and fencing.

- Your belongings and the contents of the home, referred to as personal property.

- Costs associated with temporary housing in the event that you can't live in your home due to covered damages, known as loss of use.

- Protection from liability claims if someone gets hurt on your property, referred to as personal liability.

- Coverage for medical expenses incurred if someone gets injured on or by your property, known as medical payments.

In general, homeowners insurance in Florida provides protection against damages or losses resulting from standard risks, like windstorms and hail, freezing, non-flood-related water damage, fire, and theft. Additionally, most policies in the state also encompass protection against wind damage caused by hurricanes.

However, it's crucial to keep in mind that coverage may differ based on the insurance company and policy you pick. Hence, it's advisable to carefully scrutinize your policy or consult with your agent to precisely understand what is (or isn't) included in your policy and whether it meets your specific needs.

Do Florida Residents Need Homeowners Insurance?

There is no legal obligation to purchase homeowners insurance in Florida, but it is strongly recommended, especially if you have a mortgage on your home. Your lender may require insurance as a condition of your loan, and other factors, such as owning a swimming pool or specific pets, may also necessitate coverage.

Does Florida Demand Any Unique Homeowners Insurance Coverage?

There are no mandates for specialized homeowners insurance by the state of Florida, yet some property owners may decide to invest in particular coverage based on their exposure to specific dangers.

A standard Florida homeowners policy provides protection from windstorms, including hurricane damage, but it typically does not cover water damage caused by related storm surges or floods. Additionally, standard policies typically do not cover other major events like earthquakes.

If your home is situated in a high-risk area, you may be able to acquire specialized policies to broaden your coverage. However, some locations (e.g., high-risk coastal regions) may not be eligible for coverage from a traditional home insurance company. If you cannot obtain coverage in Florida, you can turn to Citizens Property Insurance, a government-owned insurance company that offers coverage to residents who have been denied by private insurers.

Flood Insurance

Although obtaining flood insurance may not be a mandate, obtaining such a policy can be considered a wise decision.

The state of Florida is vulnerable to the effects of tropical storms and hurricanes, which can lead to flooding along the coastlines of the Atlantic Ocean and the Gulf of Mexico. Unfortunately, damage caused by flooding is usually not included in standard homeowners insurance policies. These policies generally only provide coverage for damage caused by internal sources, such as a broken pipe, or structural issues, such as a leaking roof.

If you're looking to determine the level of flood risk in your area, you can speak to your insurance agent or check out FEMA's FloodSmart.gov website.

Earthquake Insurance

While there have been a few instances of seismic activity in Florida, the likelihood of an earthquake occurring is minimal. However, if you desire to secure your home against earthquake damage, you can generally obtain coverage from most major insurance providers, including those ranked among the Best Homeowners Insurance Companies.

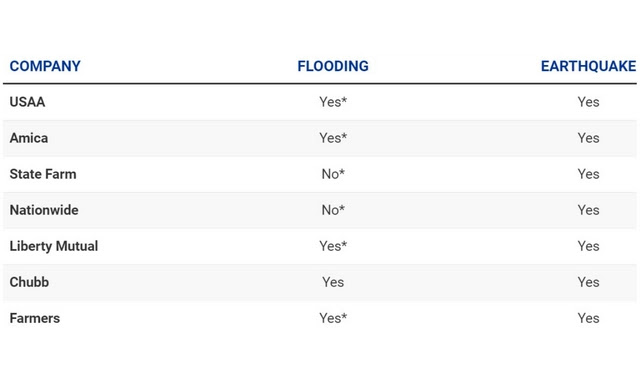

Flood and Earthquake Insurance Coverage Across Top Companies

|

| Flood and Earthquake Insurance Coverage Across Top Companies |

Explanation of Coverage Availability Designations:

- The symbol "Yes*" indicates that the policyholder has the option to purchase the coverage through the insurance company, but the insurance protection may come from an external source such as the National Flood Insurance Program (NFIP) for floods or the California Earthquake Authority (CEA) for earthquakes.

- The symbol "Yes**" suggests that a standard HO-3 homeowners policy with the insurer usually includes protection against fire damage. However, depending on the policyholder's location, this coverage may exclude or have limitations for wildfires.

- The symbol "No*" means that while the company does not participate in the National Flood Insurance Program (NFIP), policyholders can still enroll and file claims through their insurance agents or directly with the NFIP.

Homeowners Insurance Companies:

The information about insurance providers included here is intended for informational purposes only and does not imply endorsement of any particular company or product. The writers of this content and the website itself are not authorized to sell or provide insurance advice. Not all coverage options, discounts, and features may be available in every state. To learn more about any of the companies mentioned or to get a quote, please reach out to an insurance company, agent, or financial advisor directly. The content is not a general recommendation for homeowners insurance products or a specific endorsement of a particular insurer or product. Any rates listed are provided as examples only. You should reach out to the insurance provider or agent directly to get applicable quotes.

Comments